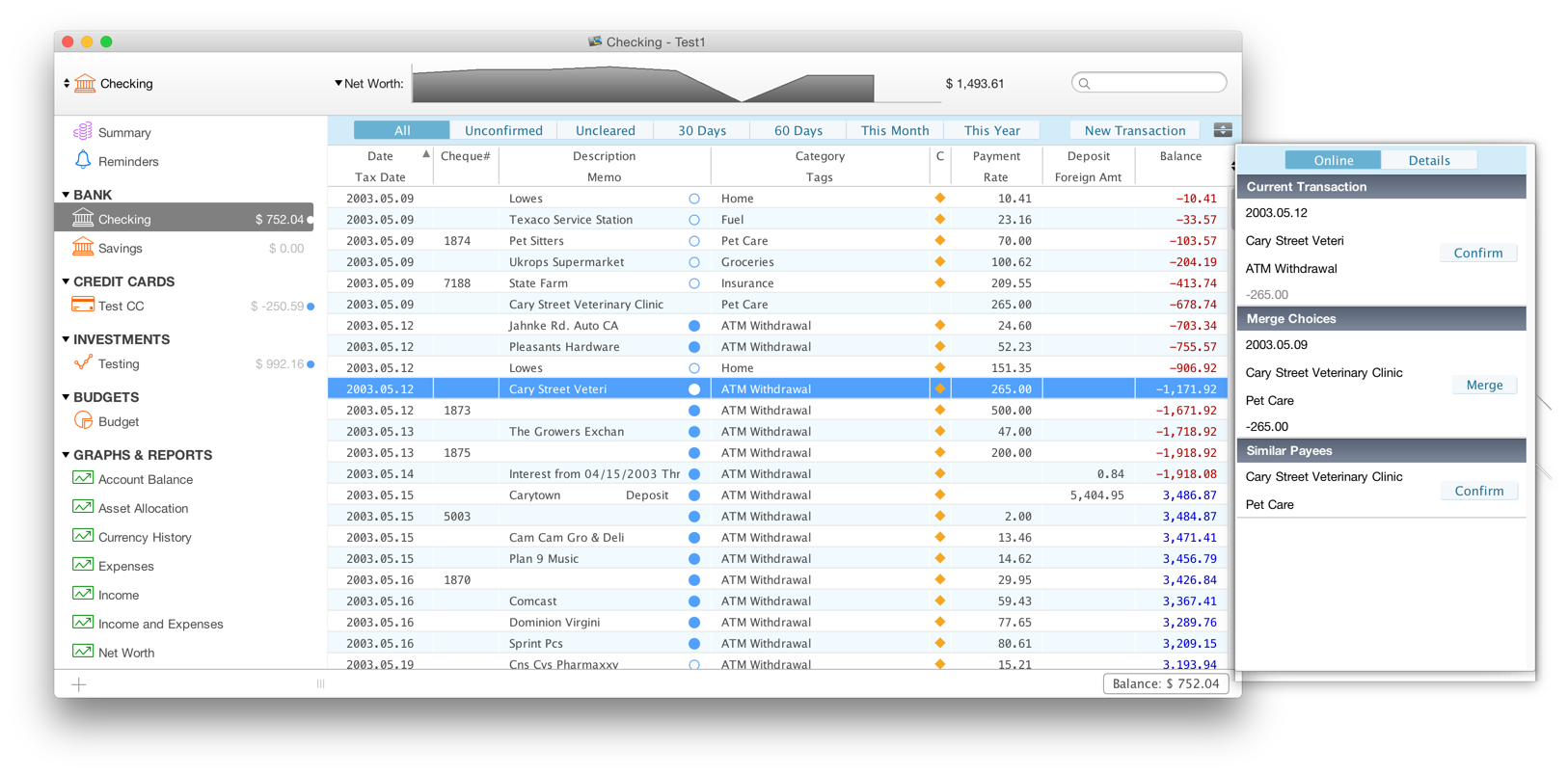

How Do You Transfer Shares From One Account To Another In Quicken 2017 For Mac

7) Now delete all of the accounts that you do not want using this proceedure for each account, one at a time: a) Right click on an account and in the dropdown box at the bottom left click on 'Go to Account List'. B) when the account list opens, look for an account that you want to delete and on that line you will see an EDIT box.

If you chose a Mac instead of a PC when you purchased a new computer, you may need to make some adjustments to import your files. If you want to transfer your Quicken files from your PC to your new Mac, you need to prepare the old files for that process.  The Mac version of Quicken offers a different set of options and abilities than the PC version but Quicken does support exporting your PC files so you can import them on a Mac. Quicken supports transferring your accounts, securities, transactions and categories to Mac.

The Mac version of Quicken offers a different set of options and abilities than the PC version but Quicken does support exporting your PC files so you can import them on a Mac. Quicken supports transferring your accounts, securities, transactions and categories to Mac.

In Quicken, ESPP purchases of the security * are logged as the security *_ESPP. When I try transferring shares out of my ESPP account (where they are all recorded as *_ESPP shares) using the 'Shares Transferred Between Accounts' transaction type, there is no *_ESPP security listed in the drop down list of securities in the transfer window. If I try selecting the * security and choose 'Specific Lots,' then I get the error message 'There are not enough open shares to cover your request (presumably because all the shares in the account are of type *_ESPP). How can I move shares from my ESPP account to a brokerage account and not lose all of the information I need to correctly calculate taxes when the shares are sold? I want to transfer the shares because I want to use them for an in-kind charitable contribution, and I would also like to be able to sell covered calls against them, neither of which my ESPP account allows. Regarding the dates on the buy ESPP transaction, yes, you are right - it was a factor for this exercise.

The path for the entire transaction was to move a specific lot of low basis ESPP shares to my brokerage account, then donate part of that lot to my charitable giving account. My plan was to sell for no gain the ESPP shares in the brokerage that I was donating, then buy the same number of ordinary shares at the same price I had sold the ESPP shares, effectively converting the ESPP shares to ordinary shares in my brokerage account with the same basis.

Then, I could easily transfer the ordinary shares to my charitable giving account, and they would have the proper basis (not a factor for taxes, but something I would still like to be able to track). (NOTE: In my ESPP purchase transaction, I used the transfer date as the date of the transaction, but kept the original dates for the start and end of the ESPP period).

When I sold the ESPP shares, quicken created two transactions (a 'Sold' and a 'MiscInc') and split the proceeds between those two. The problem you mentioned above caused all of the gain between the purchase price and the market price at the end of the ESPP period to be listed in the MiscInc transaction as ordinary income, since the sale was less than a year after the transaction date. I was able to fix the problem by adjusting the per share price of the sale upward. Note that as long as the purchase price was above the value of the stock at the end of the ESPP period, the MiscInc value will always be a fixed value, $X. By increasing the per share price of the sale to generate $X more than the desired basis, the additional gain in the Sold transaction was also $X. This allowed me to then delete the MiscInc transaction for $X, and have the remaining Sold transaction correctly report the proceeds of the sale to produce no net gain. I was then able to purchase regular shares with these proceeds and transfer them to my giving account.