Quicken Upgrade To 2017 For Mac

Quicken 2018 for Mac is out, with a subscription-only model and three membership levels (Starter, Deluxe, and Premier). Since I just upgraded to 2017 less than a month ago, I won't be making the decision about whether to abandon Quicken any time soon.

MENLO PARK, Calif.--( )--Quicken 2017 is now available for Mac and Windows. The new product line offers users a modern interface that’s easier to read and navigate, a fully featured mobile app, and new investment, reporting, and bill pay capabilities. Whether users want to stay on budget or on top of their investments, Quicken 2017 makes managing money easy, with simple, powerful tools for consumers in every stage of life. For more than 30 years, individuals and families have counted on Quicken, a leading personal money management software program, to help achieve their financial goals. Since Quicken began operating independently in March of this year, the company has significantly expanded its product development and customer care teams in order to deliver the enhancements most requested by users. Word for mac suppress footer. Multiplayer games for mac 2015 download. Designed for the latest technology Quicken 2017 features a fresh, new look that matches the latest operating systems and apps that users are already familiar with.

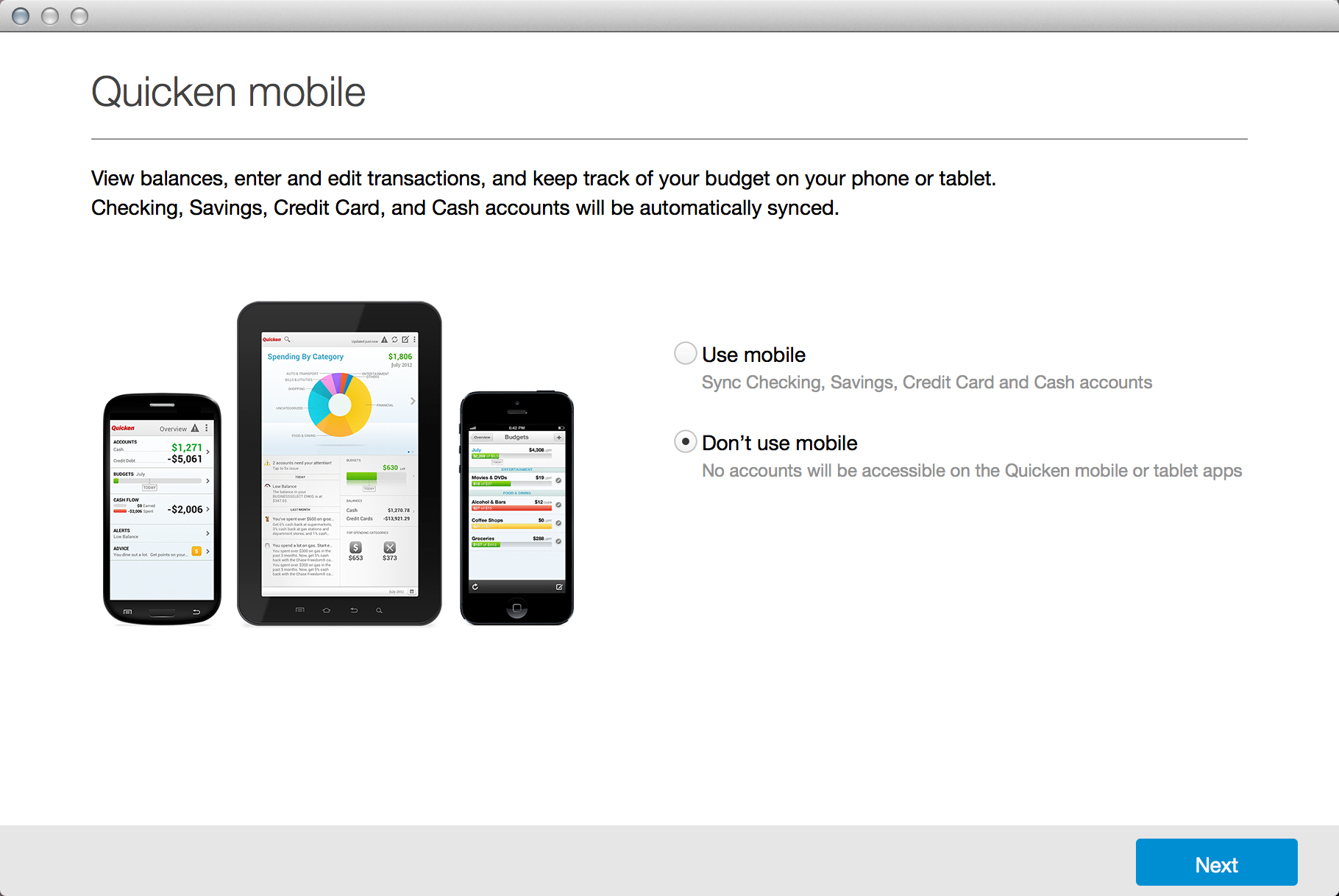

In addition, clean and consistent designs across Windows and Mac products make it easy for users to migrate between platforms. The Mac and Windows products have been re-designed to work optimally on high resolution displays. A powerful mobile app Quicken 2017 includes the biggest upgrade yet to Quicken’s mobile app, providing users quick access to a more complete picture of their finances anytime, anywhere. Mac and Windows users can now use the free companion app to track their investments, enter transactions even when they are offline, and quickly search transactions across all of their accounts. They can also view two years of transactions on their phone when they sync their data file for the first time so that they have a more comprehensive view of their spending patterns. A more complete and easy to use Windows product With the 2017 versions of Quicken Premier, Home & Business, and Rental Property Manager, users can now get automatic updates of their estimated home values, giving them a clearer picture of their total net worth.

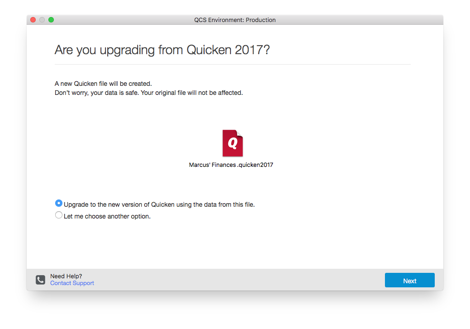

Quicken for Windows 2016 users can also seamlessly upgrade to Windows 2017 without having to convert their files. Expanded capabilities for Mac Quicken for Mac 2017 delivers on a number of key features requested by users to provide more visibility and control over their finances. In addition to the recently launched 12-month budget feature, Mac users on the 2017 product will now get new customizable reports that will enable them to track year-over-year income and spending trends, giving them deeper insights into their finances. Quicken for Mac 2017 also includes Quicken Bill Pay – these expanded bill pay capabilities allow users to pay their bills from most banks from right within Quicken, including small and regional banks (Bill Payment Services provided by Metavante Payment Services, LLC).

“Our number one priority is our customers, and building products to help them reach their financial goals,” said Eric Dunn, chief executive officer of Quicken. “Our 2017 products represent a big step forward in making it easier than ever for users to confidently manage their finances across all of their devices.” Current features for continued use Connecting to more than 14,500 checking, savings, credit card, loan, investment and retirement accounts, Quicken continues to help users manage their finances by: • Importing all bank transactions safely and automatically, eliminating the need to jot it all down or save receipts. • Categorizing all transactions automatically so that users know exactly where their money is going. • Enabling users to get on a flexible customized budget, come up with a realistic plan to pay off debt, save for a down payment, or get ready for retirement. • Providing insights on how investments are performing against the market. • Separating business expenses from personal spending and enabling users to see how well the business is doing with profit and loss snapshots anytime.